Loading...

Free consultation with ASO specialists

Doing ASO for the first time or have no idea how to carry out targeted optimization of your app?

We offer one-on-one customized services provided by app marketing specialists

Analysis of Temu's download fluctuations in the Brazilian market

2025-04-16

Analysis of Temu's download fluctuations in the Brazilian market: The e-commerce game behind policy adjustments and competitive competition

Introduction: A Chinese E-commerce Giant's Roller Coaster Ride in Brazil

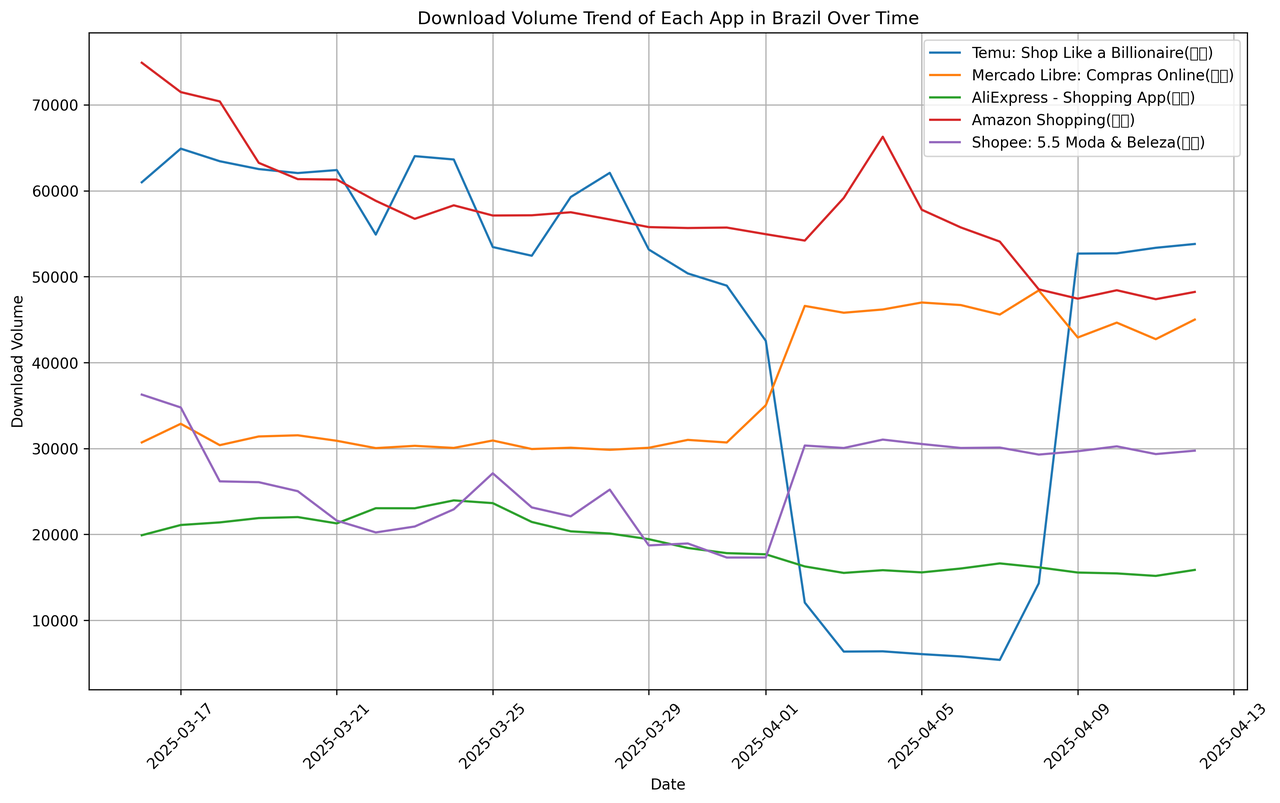

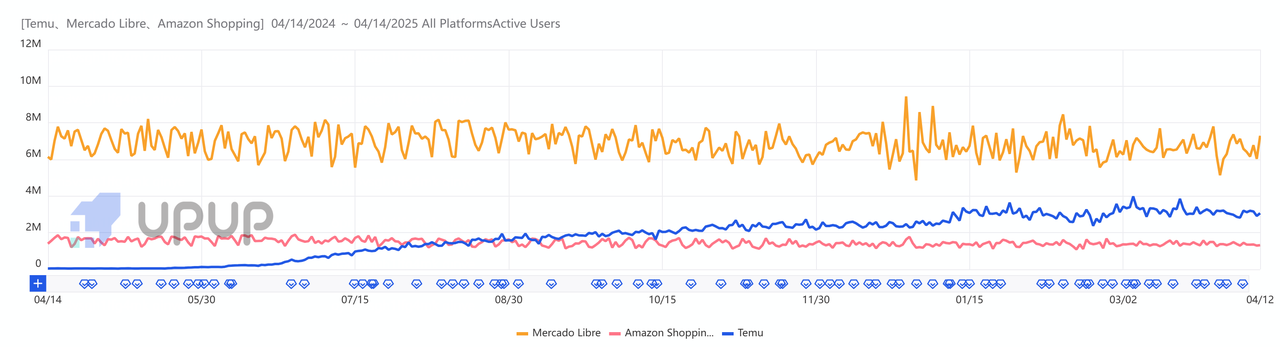

On April 1, 2025, the Brazilian e-commerce market was hit by a silent storm. The number of downloads for Temu, a cross-border e-commerce platform under Pinduoduo, plummeted from an average of 60,000 per day at the end of March to 6,356 on April 3, a drop of 85%. Behind this data, not only are there operational challenges for the platform itself, but also the multiple pressures of policy, logistics and competitors in emerging markets.

However, just a week later, Temu's downloads rebounded strongly to more than 52,000. This "V-shaped recovery" is a typical example of how Chinese e-commerce companies flexibly adjust their strategies in one of the world's most complex markets - Brazil. For mobile internet practitioners, Temu's journey in Brazil provides a vivid lesson on localization, policy risks and competitive defense.

Part 1: Downloads Plummet - The "Black Swan" of Policy and Logistics

-

The aftershocks of US policy: The butterfly effect on Brazil's supply chain On April 1, 2025, the US Congress officially launched a countdown to cancel the "T86 tax exemption policy". Although this policy is mainly aimed at the US market, the cross-border logistics shock it caused quickly spread worldwide. Temu's products in Brazil mainly rely on direct mail from China, and many international logistics providers have suspended services due to soaring costs, resulting in a surge in order delay rates on the platform. Data shows that from April 1 to 7, the number of user complaints on Temu's Brazilian site increased by 220%, directly affecting the ratings and download conversion rate of the App Store.

-

Brazil Customs New Policy: The Collapse of Low Price Advantage During the same period, the Federal Revenue Service of Brazil announced that it would tighten its tax-free policy for small packages, requiring all cross-border goods to pay 60% import tax (previously tax-free for goods under $50). This directly hit Temu, which is based on "extreme low prices." A user in Sao Paulo said in an interview: "In the past, a $10 T-shirt plus shipping cost about $15 in total, but now the tax exceeds $6 - this is almost no different from the price of local platforms."

-

Data confirms: strong correlation between policy and download volume According to data provided by users, on the first day of the policy's implementation (April 1), Temu's downloads dropped by 30%, and the next day it plummeted further by 71%. Meanwhile, Shopee, which provides local warehouse services, maintained stable download volumes, while Mercado Libre saw a surge in downloads of 33% due to its "Made in Brazil" promotional event.

Part 2: Counterattack - Temu's "72-Hour Emergency Strategy"

-

Local Warehouse Blitz: Direct Shipping from China to "Made in Brazil" On April 5, Temu announced a partnership with local Brazilian logistics provider Log-In to establish its first transfer warehouse in São Paulo, reducing the delivery time for popular products from 15 days to 7 days. According to internal documents, the platform prioritizes transferring high-frequency categories such as home goods and electronic accessories to local warehouses, accounting for 30% of SKUs. This adjustment had an immediate impact: on April 9, downloads rebounded to 52,684, an increase of 870% compared to the previous day.

-

Pricing Magic: Unboxing and Tariff Subsidies To cope with the tax pressure, Temu's technical team launched the "combination package" function within 48 hours, splitting a single product into multiple sub-orders below $50. For example, a Bluetooth headset priced at $55 was split into two items: "headset + protective case," priced at $28 and $27 respectively. In addition, the platform launched a "50% tariff subsidy" event, offsetting part of the tax burden through coupons.

-

Marketing Blitz: Easter Promotion and Social Fission On April 9, Temu launched the "Easter Egg Battle" on TikTok Brazil. Users who invited three friends to register could receive a 20-real coupon. Within 24 hours of the campaign's launch, related topics on TikTok had over 120 million views, directly driving a 52% increase in downloads in a single day.

Part 3: The Hidden War of Competition - Defense and Counterattack of Local Giants

-

Mercado Libre's "Localization Iron Wall" As the largest e-commerce platform in Latin America, Mercado Libre launched a series of measures at the beginning of April:

-

Price Benchmarking : Launching a "Temu Same" section, claiming "same low price, next day delivery";

-

Logistics crushing : By using 200 distribution centers covering the whole country of Brazil, the delivery time for promotional products is reduced to 24 hours;

-

Policy Lobbying : The Brazilian Retail Association calls on the government to strengthen cross-border tax supervision.

-

Shopee's "Silent Harvest" When Temu and Mercado Libre clashed head-on, Shopee quietly benefited from its mature local warehouse network. From April 1 to 12, its downloads remained stable between 25,000 and 30,000 times. Analysts believe that Shopee's "defensive strategy" lies in focusing on core categories (fashion and beauty) and consolidating user stickiness through live e-commerce.

-

Amazon's "High-End Breakthrough" It is worth noting that Amazon Brazil's downloads increased by 18% during this period, mainly benefiting from the cross-border tax-free benefits of Prime members (annual fee includes 20 pieces of tax-free goods quota). This differentiated positioning helps it avoid the price war quagmire.

Part 4: Long-Term Challenges - The "Brazil Paradox" of Low-Price Models

-

Policy risk is becoming the norm The Brazilian government plans to implement the "Cross-border E-commerce Compliance Act" in the second half of 2025, requiring platforms to prepay 17% of state value-added tax (ICMS). According to Citi Bank's estimates, this will increase Temu's overall cost rate from 12% to 19%, approaching its gross margin threshold (currently about 22%).

-

High localization costs The cost of building a local supply chain is much higher than expected. The head of Temu Brazil revealed that the warehousing costs in Sao Paulo are 40% higher than those in China, and the payment terms required by local suppliers in Brazil (an average of 90 days) further exacerbate cash flow pressure.

-

New Player Enters the Game: The Threat of TikTok Shop TikTok plans to enter the Brazilian e-commerce market in May 2025, and its "live streaming + algorithm recommendation" model may divert young users. Preliminary tests show that the average daily usage time of TikTok's Brazilian users has reached 98 minutes, far exceeding Temu's 27 minutes.

Part 5: Insights for Practitioners - Survival Rules in Emerging Markets

-

Agile Response: 72-Hour Principle Temu's case proves that in an emerging market crisis, the platform needs to complete the entire chain response of "problem diagnosis-strategy formulation-technology launch" within 72 hours. Its local warehouse cooperation took only 5 days from negotiation to implementation, far exceeding the industry average of 3 weeks.

-

Compliance Pre-Emption: Policy Sandbox Simulation We suggest that companies establish a "policy sandbox" to simulate risks such as tariff adjustments and data localization. For example, before entering the Mexican market, SHEIN simulated a pricing model under a 30% import tax scenario.

-

Alliance Network: Leverage Effect of Local Partners Cooperation with Log-In Logistics has saved Temu at least 6 months of infrastructure time. In addition, access to the local Brazilian payment Pix (accounting for 75% of e-commerce transactions) has increased its conversion rate by 15%.

Conclusion: The "Extreme Test Field" of the Brazilian Market

The fluctuation in Temu's downloads is not just the rise and fall of a single platform, but also reveals the underlying logic of cross-border e-commerce: in emerging markets, low-price advantages must be combined with deep localization, policy sensitivity, and capital endurance. For mobile internet practitioners, Brazil is like a prism - here, success requires playing the triple roles of "price butcher", "policy lobbyist", and "logistics geek" simultaneously.

As a São Paulo venture capitalist said, "In Brazil, there are no 'quick wins,' only 'quick adaptations.'" Temu's roller coaster curve may be the next entrant's required course.

👉 Further reading:Trump's Tariff War: The Dilemma and Future of Mobile Industry Developers